Get Pre-Qualified with No Credit Hit

Financing Options for All Credit Scores

Because Life Happens, and We’ve Got You Covered.

At Jim Glover Chevrolet, we understand that life can bring unexpected challenges. Whether you’re dealing with bad credit, a recent bankruptcy, or financial changes from divorce, we’re here to support your next step. Our tailored car loan options and bad credit financing solutions are built to help you move forward confidently. We ensure your past doesn’t hold you back from securing a reliable vehicle and a brighter future.

Finance These for Less Than $150/mo

Get your personalized down payment and monthly payment with no credit hit!

We work with the most flexible lenders in Oklahoma.

At Jim Glover Chevrolet, we collaborate with top financial partners like Chase, Ally, and Capital One, each specializing in serving different credit needs. Whether you’re looking for a prime rate, need flexibility with past credit issues, or are building credit for the first time, our network ensures you have options tailored to your situation. With this diverse pool of trusted lenders, Jim Glover Chevrolet can help you secure the best financing solution to match your unique credit profile and get you on the road with confidence.

And we partner with over 100 credit unions across Tulsa, Oklahoma City, Owasso, and Stillwater to provide you with even more tailored financing options.

At Jim Glover Chevrolet, we’ve built strong partnerships with leading financial institutions and over 100 local credit unions, including Tinker Federal Credit Union, WeStreet Credit Union, TTCU Federal Credit Union, Oklahoma Central Credit Union, and Communication Federal Credit Union. These partnerships enable us to offer customized financing options for all credit situations. Whether you have established credit, are building it from the ground up, or are working to rebuild after setbacks, we ensure you have the flexibility and support you need to get behind the wheel with confidence.

Reduce your payment by trading in your vehicle.

Reduce your monthly car loan payment by trading in your vehicle at Jim Glover Chevrolet. Use your current car’s value toward your new purchase and lower your overall financing costs. It's an easy way to upgrade while keeping your budget in check.

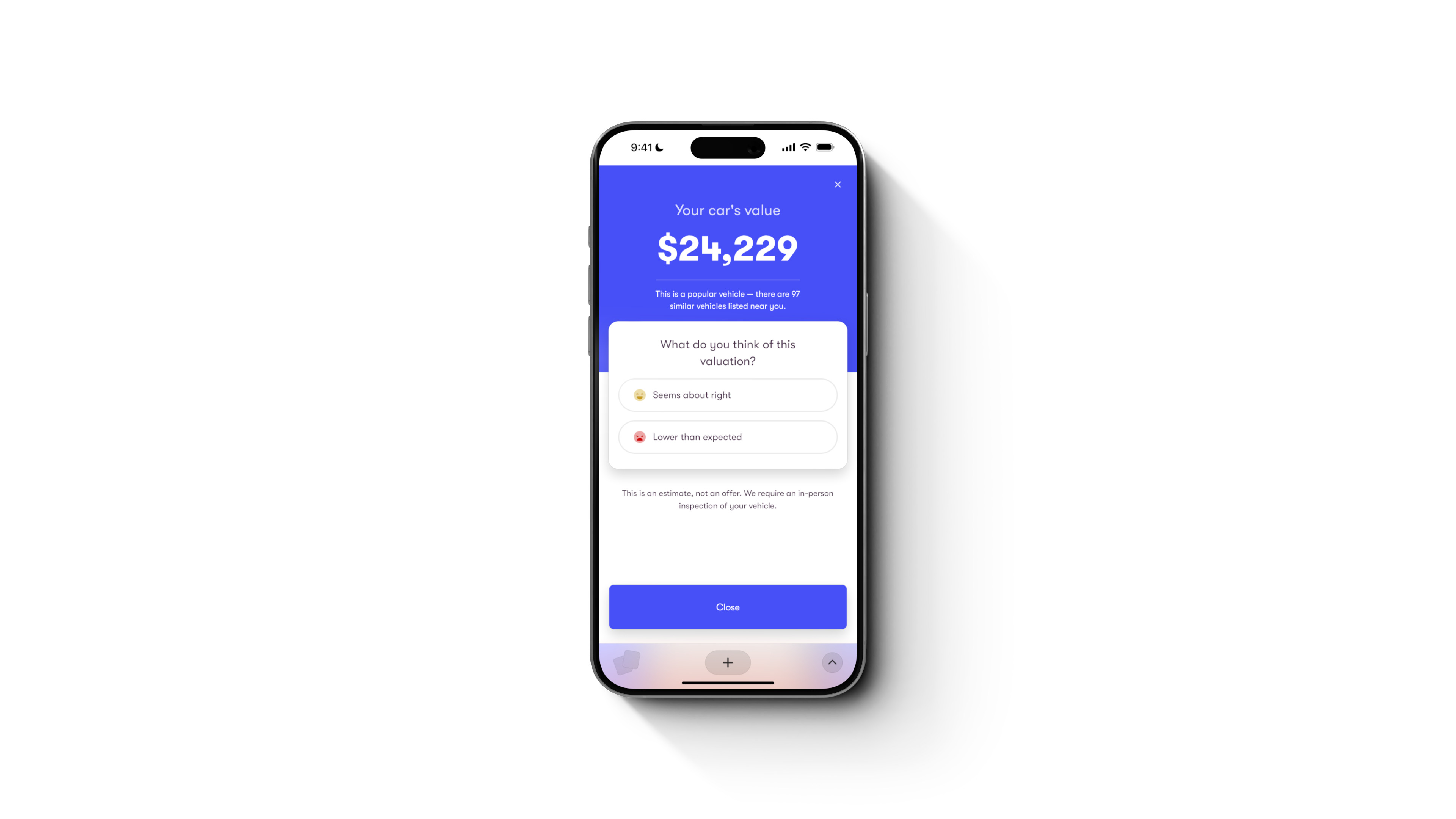

Get an estimate of your vehicle's trade-in value, based on real local market data — in under 30 seconds.

Powered by

Finannce These for Less than $250/mo.

Finance These for Less Than $350/mo

Frequently Asked Questions

Q: Do I need a down payment for a car in Tulsa?

A: Not always. While a down payment can help lower your monthly payments and improve your loan terms at Jim Glover in Tulsa, we offer flexible financing options that don't require one. Our Tulsa-based finance team will work with you to find the best solution for your needs.

Q: Can I get a car loan in Tulsa with no credit?

A: No credit? No problem in Tulsa and surrounding areas. At Jim Glover Auto, we work with a wide range of Oklahoma lenders that specialize in first-time buyers and those with limited credit history, ensuring you can get a car loan that fits your situation.

Q: What if I'm underwater on my car loan in Oklahoma?

A: If you owe more on your current vehicle than it's worth, Jim Glover Auto in Tulsa can help explore options like rolling the remaining balance into your new loan or finding a trade-in solution that works for Tulsa area residents.

Q: How can I lower my car loan interest rate in Tulsa?

A: Yes, refinancing might be an option. Jim Glover works with top Oklahoma lenders to help you explore refinancing opportunities that could lower your interest rate and make your monthly payments more manageable for Tulsa area residents.

Q: Can I buy a new car in Tulsa with bad credit?

A: Absolutely. At Jim Glover, we believe everyone in the Tulsa area deserves reliable transportation, regardless of credit history. Our Oklahoma financing partners specialize in bad credit car loans, helping you find a solution that fits your budget.

Q: How do I get pre-approved for a car loan at Jim Glover?

A: Getting pre-approved is simple at our Tulsa dealership. Fill out our online application, and we'll connect you with our network of Oklahoma lenders to find the best options based on your credit profile.

Q: How long does the car loan approval process take in Tulsa?

A: At Jim Glover, the approval process can vary, but many Tulsa area customers receive an initial response within minutes. We aim to make the process as quick and stress-free as possible for Oklahoma residents.

Q: Will applying for a car loan at Jim Glover hurt my credit score?

A: Our Tulsa dealership's pre-approval uses a soft credit inquiry, which doesn't impact your credit score. A full application may involve a hard inquiry, which could affect your score slightly.

Q: What documents do I need for a car loan in Oklahoma?

A: At Jim Glover in Tulsa, you'll typically need proof of income (such as pay stubs or tax returns), proof of Oklahoma residence, a valid driver's license, and insurance information. Specific requirements may vary by lender.

Q: Can I get a car loan in Tulsa after bankruptcy?

A: Yes, you can at Jim Glover. While your options may be more limited, we work with Oklahoma lenders experienced in providing financing to customers with recent bankruptcies.

Q: How much car can I afford in the Tulsa area?

A: A general rule is to keep your car payment below 15% of your monthly take-home pay. Our Jim Glover finance team can help review your budget and find a loan that fits comfortably within it.

Q: Can I get a car loan in Tulsa with a past repossession?

A: Having a past repossession doesn't disqualify you from securing a car loan at Jim Glover. We work with specialized Oklahoma lenders who can provide options for buyers with this history.

Q: Do you accept co-signers at Jim Glover?

A: Yes, having a co-signer with good credit can strengthen your loan application at our Tulsa dealership and help you secure better rates and terms.

Q: How can I improve my chances of getting approved for a car loan in Tulsa?

A: At Jim Glover, steps like saving for a larger down payment, improving your credit score, or applying with a co-signer can help increase your chances of approval and better loan terms.

Q: What interest rates can Tulsa buyers expect with bad credit?

A: Interest rates for bad credit loans in Oklahoma are typically higher, but they vary by lender and your specific credit situation. Jim Glover Auto will work to find the most competitive rate available to you.

Q: What's better in Tulsa - buying or leasing with bad credit?

A: At Jim Glover, buying typically involves higher monthly payments but builds equity, while leasing may have lower payments but won't lead to ownership. We can help Tulsa area residents explore both options based on their needs and credit profile.

Q: Do you have special programs for first-time car buyers in Tulsa?

A: Yes, many of our Oklahoma lenders offer first-time buyer programs designed to help those with limited or no credit history get approved more easily at Jim Glover, often with lower down payments or special rates.

Q: Can I trade in my current vehicle at Jim Glover if I still owe money?

A: Yes, you can at our Tulsa dealership. If you're underwater on your current loan (owe more than it's worth), we can roll the remaining balance into your new loan, depending on your approval terms.

Q: Do Tulsa car buyers need a co-signer with bad credit?

A: While not always necessary at Jim Glover, a co-signer can greatly improve your chances of approval and may help you secure better loan terms in the Tulsa area.

Q: How do I know if I'm getting a fair car loan offer in Tulsa?

A: Compare the interest rate, loan term, and any additional fees. Our team at Jim Glover will walk you through each detail, ensuring you understand your loan and feel confident in your choice.

Q: What happens if I miss a car payment in Oklahoma?

A: Missing a payment could result in late fees, a negative impact on your credit score, and potential repossession if payments are missed consecutively. If you're struggling, contact Jim Glover or your lender as soon as possible to discuss solutions.

We are the #1 way to finance in Oklahoma

1000+ Cars, Trucks, and SUVs • Two Locations in Tulsa Area • 10k+ Reviews